Cost of an Emergency Room Visit

Best Practices

Fear of your emergency room visit cost should never keep you from getting the medical care you need. If you think you need to see a doctor, you should make it happen, no matter the expense. That said, it helps to know your emergency room cost so you can plan for it.

Check Into Cash Promo Code

Company Profiles

The most popular Check Into Cash promo code searched for online is the pre-approved voucher. The problem is that the voucher isn’t available to just anyone.

What Is a Tax Refund Cash Advance Emergency Loan?

Loan Advice

Can I get a loan against my tax refund? It's a question often asked by people who are in financial trouble, especially if you know your refund is only a few weeks away. In truth, many can get tax refund cash advance emergency loans with relatively little effort, especially if you have a sizable return on the way.

What Credit Score Do You Need to Rent an Apartment?

Loan Advice

There are always roadblocks to finding a new place to live. You've got to find the right place in the right location, and you have to rent at the right time.

Average Interest Rates for Payday Loans

All the people who have gone to the appropriate kiosk to get a payday loan have likely asked themselves the same question: "How is the interest rate on a payday loan calculated?" Shortly thereafter, they ask themselves, "How much is it going to cost me to get this loan?"

Can You Have Two Payday Loans at Once?

Loan Advice

Sometimes the need for cash can extend beyond just one payday loan. When that happens, you will likely be better served by a financial product with a longer loan term, as paying off two payday loans on your next pay date may be too much of a strain for your budget.

What Is a Second Chance Payday Loan And How Much Can You Borrow?

Loan Advice

Almost everyone has had a financial crisis at one point or another. Maybe you are living paycheck-to-paycheck, barely able to pay on your bills when an unexpected crisis happens.

What to Expect If You Are Unable to Pay Your Payday Loans Back?

Loan Advice

Payday loans are meant to be short-term loans that help individuals cover major expenses when they don't have access to money.

Smart Black Friday Shopping Tips - Make the Most of Your Budget

Best Practices

Every year, retailers slash prices during Black Friday. It’s how stores entice shoppers. If you shop smart, Black Friday can help you spend less on big holiday gifts.

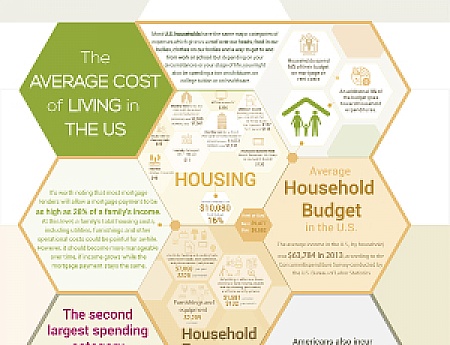

The Average Cost of Living in the US

The annual cost of living for an average household in America is $63,784, according to the U.S. Bureau of Labor Statistics. Where does all that money go? Look at the infographic below to see where Americans spend their hard-earned cash.

Best Personal Finance and Budgeting Apps of 2024

Best Practices

Need a little help with your finances? Check out our list of the top budgeting apps to help you save more, invest better, and budget wiser.

How to Pay for a Dental Emergency

Loan Advice

Visiting the dentist, even for a routine checkup, can bring with it an unbearable sense of dread. When we need emergency dental work, the dread goes through the proverbial roof. The immense pain is more than enough to send shivers through our spines, but when the physical pain ends, the financial pain takes over.

Emergency Cash for Pet Care

Best Practices

They say pets are part of the family and if you have ever brought a pet into your home, you know what that means. We spoil dogs, cats, and even rabbits like we spoil our children. The same devotion to ensuring optimal health also is important for pet owners and when one of our pets comes down with a serious illness, no expense is too great to make Fido or Felix feel healthy again.

Emergency Cash for the Unemployed

If you haven’t prepared for the loss of income caused by unemployment or you cannot rely on friends and family members to pull you through the inevitable financial crisis, you have several options to consider for emergency cash. The option you choose depends on the length of your unemployment, as well as how long you have before the serious bills (mortgage, medical, education) start flooding the family mailbox.

Emergency Cash for Single Mothers

Trying to get by financially and raise a family on one income can be difficult. The financial burden for single mothers is very real. Even if a single mother does not experience the loss of a job, she can face countless financial emergencies that range from paying to repair storm damage to taking care of unexpected medical expenses. Whatever the reason for the dire consequences caused by a major financial hit, a woman raising a family on her own might need to tap into sources of emergency cash for single mothers to ride out a financial storm.

Payday Consolidation Loans

Loan Advice

Debt is expensive – but one way to spend less on money owed is by combing your debt with a payday loan consolidation program. Read on for information about new companies in this growing industry.

Cash Advance Loan for Taxes

Everyone waits until the last second to file their taxes, whether they owe money or not. It’s a bad plan for the three-quarters of Americans who will enjoy a refund this year, as the sooner they get their money, the sooner they can put it somewhere it will accrue interest (and that’s not Uncle Sam’s pockets). But it’s understandable for the rest of us to hold on to our money as long as possible before handing it over to the IRS. If you don’t have the money on hand, you might need to use a payday loan to pay your income taxes and so you can file your 1040A Individual Income Tax Return.

Cash Advance Stores Open Late

When you’re trying to find a payday loan during afterhours, you might need to forgo your local stores and go with an online option instead. If you’re looking for a cash advance store that’s open late, then it might help to know what your options are. That’s why we wanted to compile some data for you about locations across the U.S. and what hours they tend to be open at. If you want to request a cash advance right now, you can use our online form and be paired with a lender within a few minutes.