How to Pay for a Dental Emergency

Many Americans aren't prepared to pay for emergency dental care. Check out what to look for in a dental insurance policy and the benefits of having a dental savings plan.

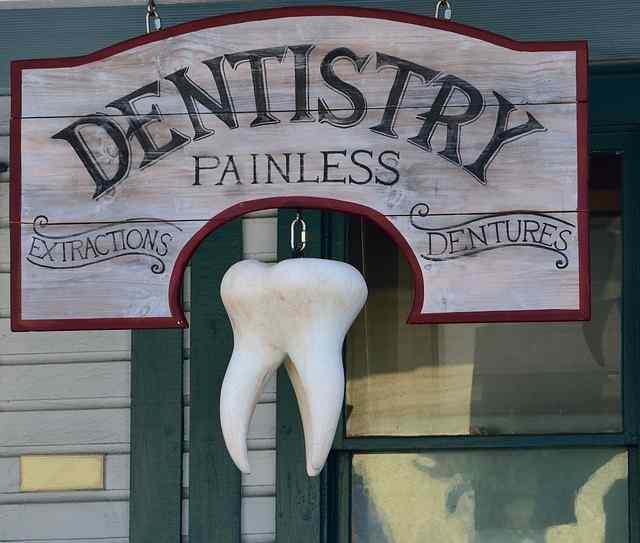

Visiting the dentist, even for a routine checkup, can bring with it an unbearable sense of dread. When we need emergency dental work, the dread goes through the proverbial roof. The immense pain is more than enough to send shivers through our spines, but when the physical pain ends, the financial pain takes over.

Many Americans are not prepared to pay for a dental emergency. In fact, between 2000 and 2010, the number of patients signing in at hospital emergency rooms for dental care nearly doubled from 1.1 million to 2.1 million. Many of the cases involved patients that did not have the financial resources to pay for emergency dental care.

This article describes the most common procedures before explaining ways you can raise emergency cash to handle a dental crisis. We conclude the article by discussing what to look for in a dental insurance policy and the benefits of establishing a dental savings plan.

Common Dental Emergencies

Here are five of the most common causes of dental emergencies.

Tooth or Teeth Knocked Out

It happens to hockey, football, and lacrosse players, but it is also a common injury experienced by casual softball players and avid outdoor enthusiasts. One or more teeth knocked out creates a long list of possible reasons for emergency dental care, including treatment for the unbearable pain of exposed nerves that dangle like live electrical wires.

Cracked Tooth or Teeth

A cracked or fractured tooth can cause more pain than a tooth that was completely knocked out. An ice pack prevents swelling, but a permanent solution requires the magical touch of a highly skilled dentist who can protect the exposed nerves.

Detaching a Temporary Crown

A temporary crown protects a cracked tooth, prevents teeth from shifting, enhances cosmetic appearance, and prevents sensitive nerve pain. When a temporary crown detaches, you need to seek emergency dental care to re-cement the binding between the crown and tooth.

Tooth Infection

If you experience a tooth infection, you must seek emergency dental care as quickly as possible to avoid having the infection spread to other areas of the mouth. Simply taking antibiotics does not solve the major health concern. You need to expertise of a dentist.

Bleeding Gums

Although not considered a painful event, a bleeding gum is a telltale sign of a serious underlying dental problem. When you discover blood in the mouth, you need to schedule an emergency session with a qualified dentist.

How to Raise Emergency Cash for a Dental Emergency

With a staggering number of Americans not covered by dental insurance, the best option to pay for emergency dental care involves raising emergency cash from one or more sources. How to pay for a dental emergency can include liquidating assets, as well as taking out loans from both traditional and non-traditional lenders.

Cash in Financial Assets

With the lack of dental insurance and the prospect of facing hundreds, if not thousands of dollars in emergency dental expenses, you should consider liquidating one or more financial assets to raise the cash needed in a timely manner. Stocks, bonds, and certificates of deposits (CDs) generate liquidity.

Remember cashing in financial investments can trigger taxes or tax penalties, especially if you are cashing out financial assets that are part of a retirement portfolio. Although you will not walk out of the bank today with the cash obtained by liquidating financial assets, you should receive the emergency funds in a few days.

Borrow from a Whole Life Insurance Policy

Another way to raise a substantial amount of cash to pay for a dental emergency involves borrowing from the equity built up in a whole life insurance policy. Because the IRS considers it a loan, you do not have to pay taxes on the money borrowed. However, you must pay back the loan or risk paying the IRS the back taxes. Another option is to cash in a whole life insurance policy, but accessing cash by ending the policy can produce a heavy tax burden.

Apply for a Home Equity Loan

If you need a large amount of cash to pay for an emergency dental procedure, taking out a home equity loan might cure what financially ails you. As with a whole life insurance policy, you have to pay back a loan derived from the equity of an asset. Since the housing bubble burst in 2007, home equity loans have diminished in popularity among lenders. Seniors that are denied home equity loans can turn to reverse mortgages for dental procedure financing. Reverse mortgages allow seniors to borrow money and not have to pay back the loan as long as they live in the same home. You eventually must pay back a reverse mortgage or lose the deed to your house.

Bank Installment Loan

Also referred to as a personal loan, a bank installment loan offers fast emergency cash to pay for a dental procedure. You enjoy the flexibility of choosing the amount of the loan and may even have some say on the term. Quick access to money works great for borrowers that need to pay for a dental emergency scheduled in a couple of days.

Supplementary Income Sources

Chances are you will need to raise money to pay for a dental emergency from more than one source. Supplementary income sources represent effective ways to figure out how to pay for a dental emergency. A garage sale generates instant cash, and you benefit from a de-cluttered attic, garage, and basement. You can sell clothing and electronic devices, as well as lawn and maintenance equipment that remains in good condition.

Do you remember the extra money you earned in grade school by cutting grass, shoveling snow, and walking the neighbor’s dog? Odd jobs provide similar benefits for adults, except you are not saving money for a family vacation or weeklong school trip. You are saving money to take care of a costly dentist bill. You can earn the first $599 from odd jobs as tax-free income.

Use Your Credit Card

Using a credit card to pay for a dental emergency can be an expensive way to raise cash if you are not able to pay back the card in full before the interest takes hold. Still, the rates on your credit card may be superior to other types of short-term loans.

Part-Time Job

Accepting a secondary part-time job is an excellent way to reduce the debt you owe for emergency dental care. A payment plan set up by your dentist can include automatically withdrawing payments from an account that you replenish with part-time job income. You can also parlay your professional skills into subcontracting work, whether you work as a licensed plumbing contractor or an accountant for a large firm.

Short-Term Loan

Short-term loans come in different shapes and sizes. A cash advance is typically for up to $500. Installment loans can go all the way up to $5,000. The way you pay back your loan will depend on the loan type. If you need emergency funding and are working with an alternative lending source, you should expect to receive your money quickly. You can have your funds in as little as one business day.

What to Look for in Dental Insurance

Dental insurance differs from traditional health insurance. Dental insurance focuses more on preventive work, such as for checkups conducted two times a year. Most dental plans cover 100 percent of preventive care, especially if you are covered by your employer’s policy. Minor treatments such as cavity fillings are usually only partially covered. For example, if you undergo emergency dental surgery that requires multiple hospital and medical center visits, you should expect to need to pay around half of the expense even if you have dental insurance.

Most dental plans cap reimbursements at between $1,000 and $1,500 per year. After you reach the annual dental insurance cap, any care you receive must come out of your own pocket. Even when you sign up for a comprehensive dental insurance plan, emergency care can still set you back financially for several months, if not several years. With the typical dental insurance policy running around $350 annually, you break even on preventive care about halfway through the year.

You Want Dental Insurance that Covers Everything

If you are a member of your family has braces, bridges, or dentures, the risk of major dental issues increases. Braces can cut into gums, and detached dentures create feeding problems. You need to pay a higher insurance premium to take care of potential emergency dental services. Dental insurance usually does not include coverage for major restorative and reconstruction procedures, and even if you find a policy that covers emergency dental surgeries, it is highly likely the policy covers only part of the final bill.

We are not trying to dissuade you from purchasing dental insurance. It’s a smart investment that will definitely help you cover expenses down the road. And, since its focus is on preventative care, it should also help you avoid bigger expenses caused by neglecting proper dental hygiene.

How a Dental Savings Plan Can Help You

A growing number of consumers have turned to dental savings plans to help defray the cost of emergency dental care. As a relatively new money management strategy for how to pay for a dental emergency, a dental savings plan allows you to sock away money for a rainy day. Many financial institutions open accounts for customers that save money for specific reasons. When the time comes to tap into your savings plan, you not only receive the money you saved, but also a little extra earned from a modest interest rate.

The Bottom Line

Advanced technology and highly skilled practitioners have caused a tremendous spike in the cost of dental care services in the United States. This is particularly true for emergency dental care, which often requires more than one appointment to alleviate pain or clear away an infection. Because most dental plans do not cover much of the cost incurred from emergency dental care, consumers are left on the hook for bills that can run thousands of dollars.

Although it remains important to own dental insurance coverage, you also have to plan for the worst-case dental scenario by saving money for expensive treatment down the road. Your financial foresight might not be enough to cover emergency dental care, which means someday you will have to implement other financial strategies to pay for a dental emergency. Some of the better options include applying for a personal or home equity loan, as well as borrowing against a whole life insurance policy. You can also work a second part-time job and raise cash by performing odd jobs.