Beginner’s Guide to Free Investment Apps

The pandemic has seen an all-time rise in investment app users, most of whom are young adults with little to no investing experience. Job furloughs, market crashes, and interest in building an emergency fund to avoid needing to borrow emergency funding have all resulted in record numbers of people looking to invest or trade. Millennials, in particular, report wanting to immerse themselves in the investment and trade market but see the initiation fee as too steep. For young adults suffering from financial insecurity or who otherwise don’t have a strong financial foothold, investment and trading can seem anywhere from improbable to dangerous.

With the slew of investment apps available, each with their own functionalities and investment approach, identifying which ones are best for your specific situation can be challenging. Here, we’ll help you find your best option based on your buying habits, financial status, and earning goals.

Comparing Investing, ‘Spare Change’ Investing, and Stock Trading

The three types of investment apps are investment, spare change, and stock trading. The difference between them boils down to time commitment. How much time and patience you’re willing to dedicate to your finances will largely determine which avenue is more appealing to you.

Are you someone who likes to bide their time, waiting for the perfect opportunity, or do you spring on the first enticement that comes your way? If you’re the former, you might be interested in long-term investing. Thrill-seekers, on the other hand, might be more drawn to short-term stock trading.

Spare change investing refers to a service that automatically rounds up the spare change from purchases made with a credit card. For example, if you were to buy a coffee for $3.75, the app would charge you $4.00 and deposit the remaining 25 cents into your investment accounts.

Before committing to one approach to money-making, there are a few questions you should ask yourself.

- How much money can you put aside for investment and stock trading?

- How much time can you commit to following market trends and adjusting your strategy?

- How much risk are you willing to undertake?

One approach is not better than the other; each come with their own potential advantages and pitfalls depending on your financial goals and abilities. With so many apps to choose from, we’ve narrowed it down to just a few within each category to help you find the best investment strategy for your needs.

Investment Apps

“Micro-investment” apps and platforms use AI software commonly termed ‘robo-advisors’ to allow users to invest in stock or dollar-based amounts, depending on the app. Robo-advisors are soaring in popularity as a low-cost, effortless alternative to traditional financial advisors. Robo-advisors are used by every app and platform on the so-called “free investment” market and are among the main reasons why investment apps are so popular among the younger crowd. Robo-advisor apps charge anywhere from .2% to .5% in flat-rate annual fees, slashing service rates to half that of traditional financial advisors. They are also far more accessible, allowing 24/7 financial service access to anyone who has a mobile phone.

Best investment app: Betterment

Betterment markets itself as “smart investing for the long-term,” which is exactly what it enables users to do. The app’s automated investing tools take the wheel for users who may not feel confident in their ability to invest smartly or who otherwise don’t want to put in the research hours themselves. Betterment requires no minimum amount to start investing, with only a small annual fee of 0.25% for Betterment’s portfolio management services. For the more serious investor, there’s the option of purchasing Betterment Premium, which grants access to a team of professional advisors available via email and phone. This additional service comes with a 0.4% annual fee and a minimum investment of $100,000. Based on your investment motivations – whether saving up for your dream home or next travel adventure – Betterment will automatically update your portfolio to reflect your financial goals, making this an excellent option for those just starting out.

‘Spare Change’ Investment Apps

Apps like Acorns, Stash, and Chime have popularized the ‘spare change round-up’ investment strategy. These apps are disproportionately popular with the millennial crowd, most likely because of their favorable terms and no-effort investment style. Perhaps most importantly for young people, they operate under the premise that you don’t need large sums of money to start investing. ‘Spare change’ investment apps can be fairly low risk, but also low reward. Utilized correctly, however, and they may net you some gains.

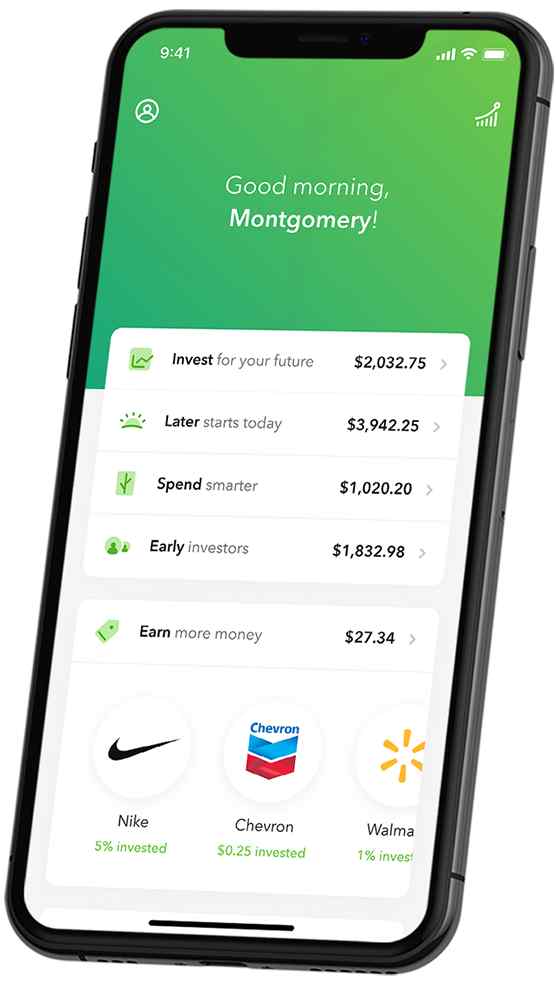

Best ‘spare change’ investment app: Acorns

Acorns has been around the longest and only continues to grow in popularity. Though not technically free, Acorns has all the best features ‘spare change’ investment apps have to offer for the beginner investor at a next-to-nothing cost. Similar to Betterment, Acorns allows users to invest based on a dollar and stock-based amount. They also provide an automated service that will invest for you based on your financial preferences. Acorns allows you to utilize the convenience of a robo-advisor while still maintaining control of your finances. You’ll have the option to build a well-rounded portfolio centered around your comfort level with investing, meaning that both conservative, and risky investors can feel comfortable with where their money is going. Your portfolio will automatically update based on this risk factor and your investments will adjust accordingly. Acorns’s all-in-one approach to investment, retiring, and saving is also a big draw. Users have everything they need at their fingertips to build up various accounts and can even receive an Acorns debit card. Depending on the plan you choose, monthly fees range from $1 to $5 per month, making this a safe, affordable gateway into investing.

Stock-Trading Apps

Often, those just breaking into the market will opt for trading. On the outside, it seems instantly gratifying and with little commitment. Sure, you may see the rewards of a good trade sooner than the results of a good long-term investment, but the thrill of gains isn’t always sustainable. If you don’t know what you’re doing, you’re taking a gamble – and not necessarily a smart one.

There are no wrong choices, but keep in mind that not all apps are created equal, nor do they have the same basic capabilities or focus. Most apps on the market are reliable; however, as far as stock trading apps are concerned, I would not recommend Robinhood.

Robinhood faced severe backlash in March of this year and again in August when frequent app crashes resulted in incorrect charts and lost money. Some users were not able to access the app at all. This led to a number of lawsuits, but due to a stipulation in the user agreement that absolved Robinhood of responsibility, the company was not held liable for its users’ losses.

When it was first released, Robinhood dominated app-based stock-trading, and for good reason: it was the first app to eliminate trade commission fees and allow users to begin trading with a $0 starting point. This was a huge draw to novice traders because it eliminates one of the major barriers to trading. Extra fees are pesky for anyone, but especially for beginners liable to make mistakes at first.

However, there are now several apps that offer this, and not at the expense of security and excessive risk. One of those is TD Ameritrade.

Best stock-trading app: TD Ameritrade

TD Ameritrade is an online and mobile stock trading experience perfectly suited for beginners. The app offers mutual funds, bonds, exchange-traded funds (ETFs), individual stocks, and forex. Their market research and educational tools for beginners are top-tier. The wealth of information and resources on TD Ameritrade is so vast that it may work against itself. While TD Ameritrade is still arguably the best app available for novice traders, the many options you have can become overwhelming. The upside of this is that as you grow to understand the industry more, the app will continue to have utility. You’ll discover more features and develop an even better understanding of what is possible. As with any of these platforms, a complete beginner still has to overcome the learning curve. However, TD Ameritrade gives you all the tools you need to do just that. TD Ameritrade is scheduled for acquisition by Charles Schwab but is, for now, its own entity. With that in mind, it’s hard to say what the future holds for TD Ameritrade, but, for now, it’s one of the best stock-trading apps out there.

Should You Invest?

Trade and investment apps are intended to make investing accessible to the average American. Certainly, the average American can use these apps to their benefit, whether their goal is to invest, save money, learn to trade, or all three. Keep in mind, though, that these apps boil down what is a convoluted process to something consumable. Most apps on the market are just bite-sized pieces of the real thing. Though these apps are designed to be an alternative to traditional institutions, seeing a financial advisor in the flesh may not be a bad idea. You might even combine a financial advisor’s advice with your own app-based strategy or upgrade to a premium service that allows you access to financial advisors through the app itself.

There is no guarantee for success with investing or trading. Nor is it a simple process to understand. If it were, everyone would be doing it. However, if you’re someone who has a grasp on the market and can craft a smart business plan (perhaps with the help of a financial advisor), and is willing to dedicate the time and energy it takes to make smart moves, you may be ready to take the plunge into the world of app-based investments.