What Is the Minimum Monthly Payment on Medical Bills?

A few months ago, I walked out of the hospital with a folder packed full of paperwork. The surgery I needed went well, but the bills arrived soon after, and the numbers were large. Like 41% of adults in the U.S. burdened with medical debt, I wondered if a small monthly payment was my only option. Could there be a smarter way to handle medical debt?

I began researching my options and thinking: what is the minimum monthly payment on medical bills? Along the way, I discovered several simple strategies to handle medical bills. And now, I’m here to share these insights with you.

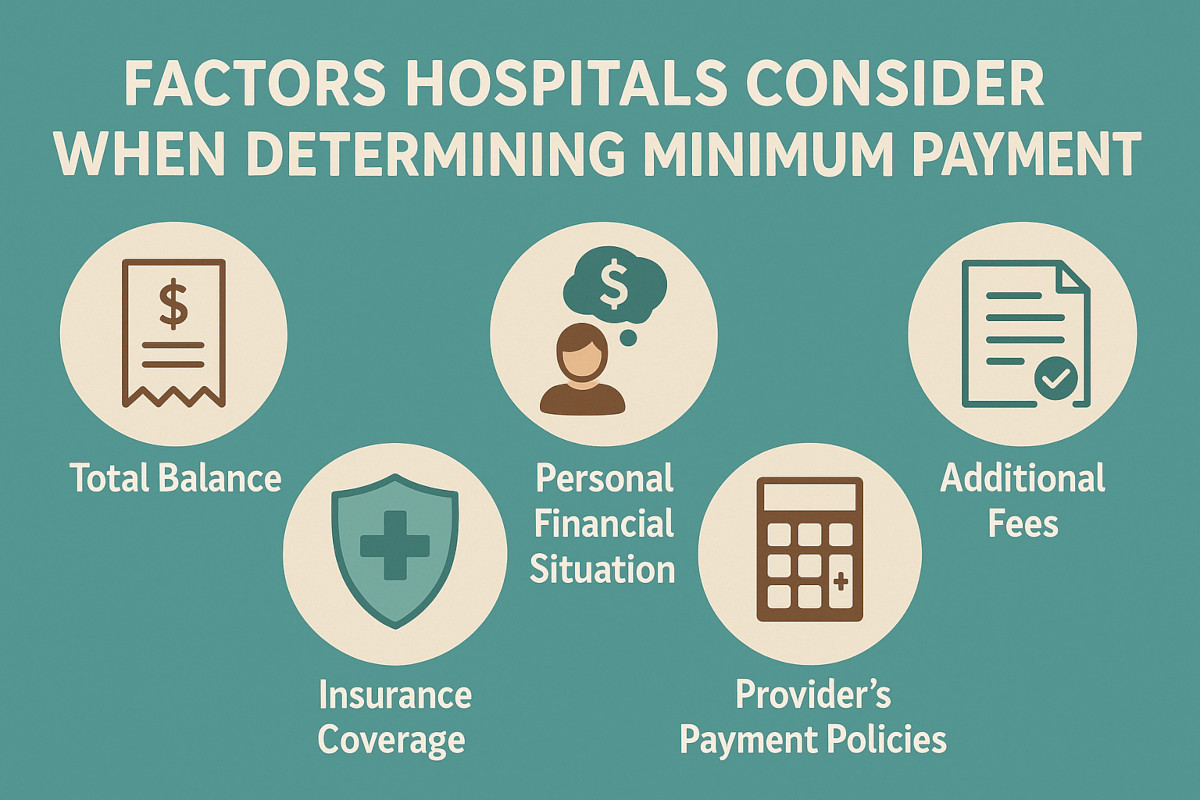

How Is the Minimum Payment Determined?

Unlike credit card companies, where minimums are often set by a standard percentage, hospitals and clinics have individual policies. This means that there isn’t a legal minimum amount set. Each provider handles the minimum monthly payments in different ways.

However, they all consider the following main factors when determining minimum payment:

- Total balance: The more you owe, the more you may be asked to pay each month.

- Insurance coverage: Your provider will look at what your insurance covers before suggesting a medical bill payment plan.

- Personal financial situation: Some hospitals may work with you on an individual basis if you show proof of financial hardship or lower income.

- Provider’s payment policies: While some hospitals have strict rules, nonprofit hospitals follow guidelines from the American Hospital Association that encourage flexible payment.

- Additional fees: Some medical bills charge late fees or interest, which can change your minimum payment amount.

Can You Lower Your Minimum Monthly Payment?

Many people think that they’re stuck paying whatever the hospital says, but there’s usually room to negotiate. In fact, negotiating is one of the things that the Consumer Financial Protection Bureau (CFPB) highly recommends people do to increase their chances of a flexible and interest-free repayment plan.

As soon as you receive your medical bill, call the billing office to explain your situation and suggest a solution that works for both of you. Communicating early may increase your chances of a flexible arrangement before late fees start. Gather tax returns, pay stubs, or bank statements, if necessary, as proof to qualify for hardship programs.

In some states, nonprofit hospitals offer discounted or free care to patients who fall below certain income thresholds. For example, in New Jersey, the state mandates that hospitals provide free care to uninsured residents with incomes up to 200% of the federal poverty level. It also mandates discounted care for those with incomes between 200% and 300% of the federal poverty level.

Another option is to ask if they allow healthcare payment plans without interest. Such plans keep costs lower over time. If you’re paying off medical bills in a lump sum upfront, try to negotiate a discount on the total balance.

Always keep a record of who you spoke with, the dates, and what was discussed to avoid confusion later.

What Happens if You Only Pay the Minimum?

The good thing about paying the minimum every month is keeping your account in good standing. However, small payments can stretch the debt over many months or years, especially if more fees are added. When this happens, you might end up paying more than your original bill. But what happens if you don’t pay medical bills at all, and the amount gets out of control? Providers may send delinquent accounts to collections, which will bring extra stress and more charges.

On the bright side, in January 2025, the CFPB introduced a new rule that completely removes medical debt from credit reports. This change could be a tipping point for about 15 million Americans as it eliminates $49 billion in medical bills from their records. With this financial burden no longer affecting their credit scores, many people may find it easier to qualify for loans and access better financial opportunities.

Nonetheless, if you want to pay off medical bills faster, try to pay more than the minimum when possible. Even the smallest amount can make a difference in the long run.

Alternatives to Paying the Minimum Monthly Payment

Let’s explore what other alternatives you may have instead of paying the minimum monthly payment:

- If you have a health savings account (HSA) or flexible spending account (FSA), you can use it for qualified medical costs like doctor visits and medical stays. Also, withdrawals are tax-free, so you can benefit from that.

- There are some charities and foundations out there that help people cover medical debt. They may even show you how to get out of debt. For example, the HealthWell Foundation or CancerCare assists individuals with chronic or life-altering diseases.

- If you’re a low-income individual or family member, pregnant, elderly person, or an individual with a disability, check if you qualify for state-funded help like Medicaid or CHIP. They may also help you pay hospital bills without insurance. Make sure to visit your state’s official site or Healthcare.gov for more information.

- You could also get in touch with medical bill advocates. These are experts who spot mistakes on your bill and negotiate lower charges on your behalf. These advocates belong to organizations like the Alliance of Claims Assistance Professionals (ACAP).

However, unlike the rest of the options, working with medical bill advocates will cost you money. Some may ask for an hourly rate, while others offer a flat fee. On the other hand, that amount may be a portion of what they save you.

Tips for Managing Medical Bills Efficiently

How to pay medical bills without stress? Well, managing unexpected expenses like your medical bills can be a lot easier when you adopt some simple habits to keep you in control of your finances.

First, start by gathering every piece of paperwork and keeping it in a dedicated folder. This includes detailed records of all your bills, receipts, and conversations with billing departments.

Why go through all this trouble? Because having all your documents in one place can help you spot billing errors like duplicate charges or billing for services you never received.

Next, take a look at every charge listed. Even small mistakes, such as a wrong medication fee or an extra procedure, can add up over time and hurt your wallet.

Lastly, set up automated payments or scheduled reminders. This way, you can never miss a due date, avoid late fees, and keep your account in good shape.

Sum Up

So, the minimum monthly payment for medical bills depends on your provider’s policies, the amount you owe, and your personal finances. While making a small monthly payment might keep the bill from going to collections, it often leads to a longer, and sometimes more expensive, payoff period. But don’t worry. If you act quickly and negotiate, you may get rid of medical debt and lock in a more manageable payment plan or even reduce your total balance.

FAQ

How Do I Know What My Minimum Payment Will Be?

Your provider calculates your minimum payment based on your overall balance, payment policies, and any specific plan you negotiate. If you’re not sure about it, contact the billing office to get an exact amount.

Can I Change My Monthly Payment Amount?

Reach out to your provider if your financial situation changes or the payment feels too high. Many may be willing to adjust if you can show the need. If you're working with a nonprofit, request a formal review under their hardship program — they are required by law to consider it.

What Happens if I Miss a Payment?

If you miss a payment, you risk late fees, which may result in collection notices if payments fall behind. Luckily, as of January 2025, missed medical payments won’t show up on your credit report and damage your credit score. If you’re facing extreme hardship, remember that the CFPB provides resources on medical debt relief.