How a Short-Term Payday Loan Online Works

We help consumers look for a payday loan, which is a short-term loan provided by a payday lender. A payday advance online is designed for emergency purposes, and it is characterized by two of its main benefits: speed and availability. Bad credit may not automatically disqualify an applicant for a payday advance. If you are interested in financing your emergency expenses, then you picked the perfect place to get started.

What Is a Payday Loan?

A payday loan, also known as a cash advance or a payday advance, is often used as an alternative to traditional financing, such as personal loans from a bank or credit union. Payday loans are often used with the same purpose as personal loans. Both can cover expenses such as medical bills, debt consolidation, or otherwise big purchases.

Online payday loans are different from traditional personal loans in a few ways, though. The main difference is in payday loans' basic terms.

Payday loans are considered short-term. That means they are due back quickly – usually, as soon as the borrower's next paycheck arrives. For this reason, payday loans are best used to fund a short-term expense when you're strapped for cash between paychecks. Depending on state regulations, payday loans can sometimes be refinanced or rolled over at a fee if the borrower cannot repay the loan within the agreed-upon time frame. However, it is still best to pay off a payday loan as soon as possible, as the loan will continue to accumulate interest and fees until it is repaid in full.

Payday loans are high-interest. Another difference between payday loans and traditional personal loans is that payday lenders may charge a higher annual percentage rate (APR), which is the interest rate tacked onto the loan. Other fees that may be tacked on include finance charges, an origination fee, and rollover fees (if applicable). These fees are usually higher than what you will see with traditional loans.

Though a payday loan can sometimes be more expensive than a traditional personal loan, there are several reasons why consumers choose payday loans over bank loans.

For one, they are more readily available for consumers with little or no credit history. While all payday and cash advance lenders will check credit before approving an applicant for a loan, payday lenders often do not have strict credit requirements like banks and credit unions. Unlike bank loans, there may be no credit minimum to apply or even to be approved for a payday loan.

Additionally, payday loans are sometimes a quicker source of cash than personal loans. Direct payday lenders often provide funds more quickly than traditional banks. Unlike banks, which have a multi-step approval and disbursement process, direct payday lenders typically have a more straightforward approach. This streamlined process, with fewer bureaucratic hurdles, may result in faster access to funds for borrowers.

What Are the Terms for Payday Loans?

Navigating through financial challenges can be difficult, and payday loans often serve as a solution, offering flexibility in terms of repayment periods.

30-Day Payday Loan

A 30-day payday loan is a short-term lending option where the borrower commits to repay the cash loan within a month. This option has its unique advantages:- It provides a quick cash solution for immediate financial emergencies like unexpected bills or repairs.

- It's a short-term commitment, which means you'll be free from the debt quickly if you can repay on time.

- The overall interest paid is typically less due to the shorter repayment term, potentially reducing the total loan cost.

Three-Month Payday Loan

On the other hand, a three-month payday loan is a medium-term loan that offers a balance between quick repayment and having sufficient time to organize your finances. Its benefits include:- More manageable repayments, with the loan amount spread over three installments.

- Additional time to accumulate the funds necessary for repayment, decreasing the likelihood of missed payments.

- Greater flexibility compared to 30-day loans, especially for those who need a little more time to balance their financial situation.

Six-Month Payday Loan

The six-month payday loan is a longer-term loan option suitable for borrowers who require larger loan amounts. Its distinctive advantages are:- Lower monthly repayments due to the loan being spread out over six months, making it easier to manage within your budget.

- An extended repayment period provides time for better financial planning and organization.

- A feasible solution for larger financial needs, as the longer term makes repayment of a larger amount more manageable.

Payday Loans at a Glance

- Distributed through a direct lender

- Short-term

- High-interest with additional fees

- Best used in case of emergency; not a long-term financial solution

- Can be used to cover most expenses

State Regulations for a Payday Advance

Online payday loans are regulated the same as loans from a brick-and-mortar payday lender.

Many states will place limits on the interest of a payday advance. Nineteen states have regulations that limit the APR on a small consumer loan to 36% or less, while most other states allow higher rates, according to the Center for Responsible Lending and the Consumer Financial Protection Bureau.

Many states will restrict the loan term and amount. Your state may even keep you from borrowing money if you have too many outstanding balances. To practice responsible lending, check your state's webpage to see what applies to your circumstance.

Where to Find a Fast Cash Loan Online

You don't need to go very far to request a payday or installment loan. We provide the service right here.

Using our loan request form is one of the easiest ways to start your search for a deferred deposit loan. Using our form does not require an origination fee or any other fees.

We streamlined the entire payday lending process. Just fill out all the fields you see in the following sections:

Personal information - This is where you tell us about yourself. We try to be as unobtrusive as possible, but we need to know things like your address and birth date to meet our requirements to connect you with a lender.

Employment information - Our lenders need to know how you will be able to pay back your loan. You don't have to have a job or a credit union account to be connected with a lender, but you need to have a dependable revenue stream, such as a gross monthly income.

Bank information - A payday lender may deposit your loan money directly into your bank account and then withdraw the loan money plus the fees and interest at the end of your loan term, according to your repayment plan. This means the lender needs to know if you have an active bank account or not. This is why we ask you for your current banking information.

Your data is kept safe throughout the entire loan request process. We ensure this in the following ways:

- We only work with reputable lending companies.

- We protect your data with 256-bit encryption.

- Our staff is trained in the best practices for on-site data security.

If you have any questions about the loan request process, we invite you to contact us. Of course, the easiest way to understand how to use our service is to try it out for yourself. We have made it as easy as possible to get started. Simply click the "Get Started" button at the top of the page to see for yourself.

Working with a Lender

A payday lender can provide funding in a few different ways.

One option is direct deposit. Through direct deposit, the funds are added to your bank account. This account can be a savings or checking account. This means that you can apply for payday loans with a savings account as well. You may receive the funds in as little as one business day.

Before receiving a short term loan, you should see a loan agreement. If the interest rate seems high, you may want to check with the credit bureaus to see your credit report. A low score could be the reason for higher rates. Using credit counseling services may help you increase your score.

Certain payday lenders let you request a prepaid debit card. Those without access to a credit union or checking account tend to prefer this option. The cards contain the full balance of the loan. Customers using this option may receive a PIN and other security measures to help ensure that transactions made with the card are legitimate.

Payday Loans with prepaid debit cards allow customers to get cash, giving them access to withdraw a part of their balance when necessary.

Taking a cash advance isn't free, however. When you borrow from the payday lending industry, a percentage fee might be subtracted from your balance as well. This origination fee will vary from lender to lender. In some cases, lenders may be willing to waive the fee for your payday advance.

Requesting short-term cash can help the borrower overcome financial struggles!

You can get started right here.

How to Get a Payday Loan Online

Lenders typically require the following information:

- Proof of employment

- Paychecks from previous weeks

- A valid ID

- Contact information

- Invoices and receipts relevant to your financial situation

Proof of employment is essential to many online payday loan vendors. You need to show that you receive a steady income. Without one, you will have trouble finding a lender open to working with you.

Past paychecks may be useful when qualifying as a payday borrower. It shows lenders that your earnings are consistent.

A valid ID may be required. A driver's license is preferred in most circumstances. Tax documents, like your W-2, may also be acceptable. Without a valid ID, you likely won't be able to work with a payday loan vendor.

Lenders will typically request multiple ways of contacting you or your immediate family. You will need to provide them with your current address as well. If you're living with a friend or a family member, their address may be acceptable.

You may want to send the lender any invoices and receipts relevant to your financial struggles. These can show your financier that you have accurately represented the costs and expenses you're facing. If these expenses are related to a disability or dependent, lenders may be willing to negotiate a larger personal payday loan./p>

Payday loans online can be effective ways to get urgent funds quickly. If you use them responsibly, they can be useful in managing your short-term expenses.

How Can You Make a Request?

Requesting a payday loan has become simpler and more accessible. Here are some ways you can request a payday loan:

Online: To submit a payday loan request online, you'll first need to visit the lender's website. Here, you will find an application form to fill out. This form will typically ask for personal information such as your name, contact details, employment status, and income, along with your bank account details for depositing the loan. Once you've filled out this form, you can submit it directly on the website. The lender will then review your application and respond with their decision on-screen or through email.

Over the Phone: To request a payday loan via phone, start by calling the lender's customer service line. A loan representative will guide you through the application process. During this call, you'll provide similar personal and financial information as you would online, including your name, contact details, employment status, and income. You'll also share your bank account details for the loan deposit. The representative will record your information and submit your application for review.

Account Requirements for a Personal Payday Loan

Maintaining an active checking account greatly enhances your chances of qualifying for a payday loan. Without one, you may find the loan approval process challenging.

To clarify, let’s delve into some commonly asked questions about the type of bank account lenders typically prefer applicants to have.

Can You Get a Loan With No Checking Account?

Payday lenders typically require borrowers to have a checking account as it allows them to deposit the loan funds directly and to schedule automatic repayments, providing a measure of security for the lender. Still, it may be possible to get a loan without a checking account. However, your options may be limited and potentially more expensive.Can You Get a Loan With No Bank Account?

Getting a loan without a bank account will likely be extremely difficult. Most lenders require borrowers to have a bank account to verify their income, deposit the funds, and automatically withdraw repayments. Some lenders may accept alternate methods of transferring funds, like prepaid debit cards. However, these loans can carry very higher fees and stricter requirements.Can You Get a Loan With a Savings Account?

In some cases, you can get a payday loan with a savings account. Certain lenders may allow borrowers to use a savings account if a checking account is unavailable. However, not all lenders offer this option, and the terms can differ.Factors to Consider When It Comes to Payday Loans

While payday loans or payday advances are great financial options, there are some factors to consider. Most notable is the interest rate, which can be higher than a credit card finance charge.

If your financial standings are bad at the time of your application, the lender may limit what you can purchase with your loan. This is rare, however. Typically, lenders do not tell you how to spend your money.

There are plenty of advantages to using a short term loan. A payday advance acts as emergency cash when you cannot access basic credit. But if you work with a provider long enough, they may trust you enough to give you a larger loan.

Online outlets are quick and straightforward, offering fast cash when you can't make it to an in-store location. In fact, many prefer applying for an online small consumer loan.

Who Uses Shorter-Duration Funding?

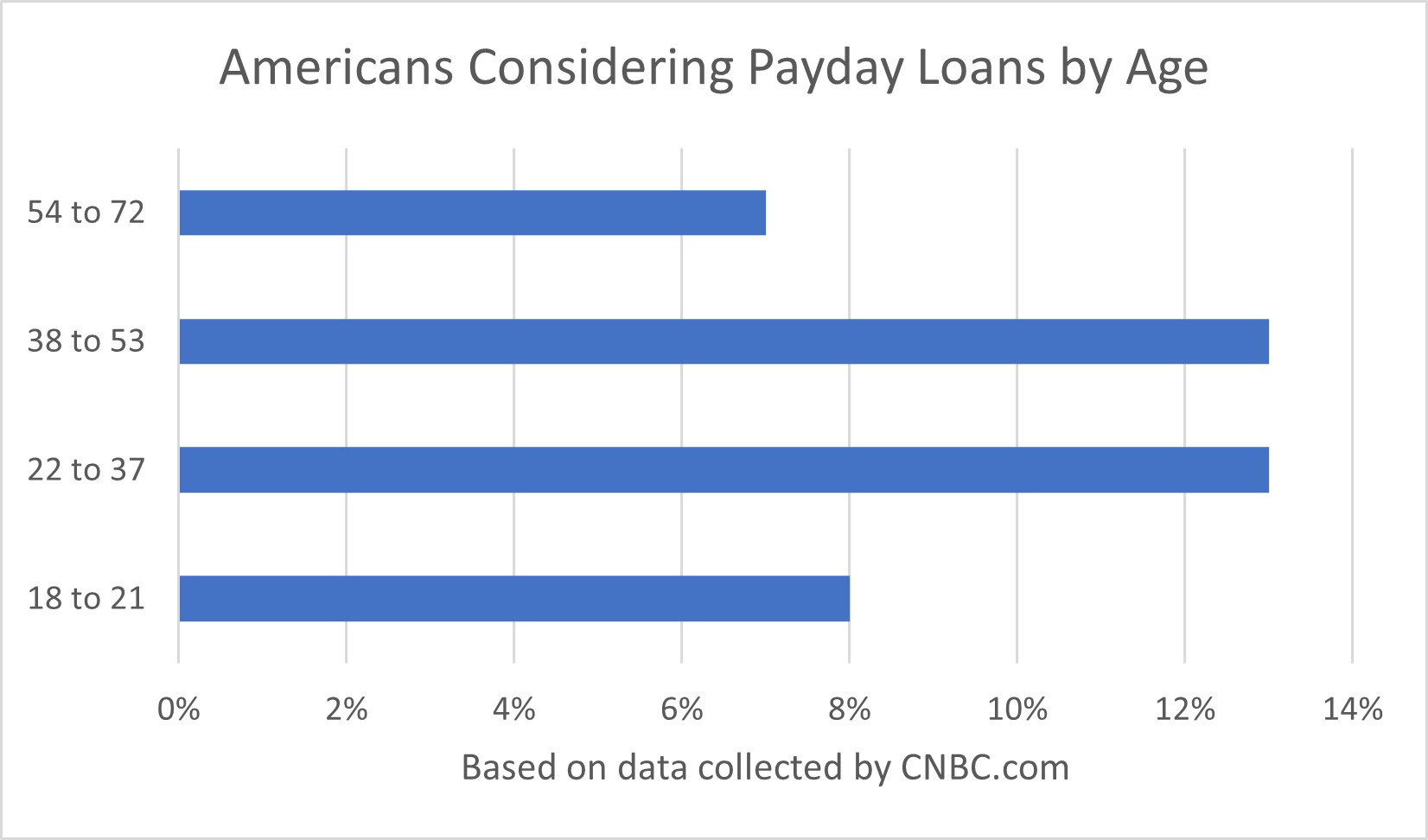

If you're in a specific age group, you may be more likely to take out a payday loan.

Here is a bar graph that shows the percentage of U.S. adults who have requested a payday loan recently:

The data in the graph above was taken from a study by CNBC.com that surveyed over 3,700 adults from across the country. The study also showed that nearly half of millennials have considered taking out a payday loan. Only 7% of baby boomers have made the same consideration, compared to 16% by Generation X and 38% by Generation Z.

Short-term payday lending may make sense for the following types of people:

- Those with bad credit who cannot receive traditional funding, such as a bank loan or a credit card

- Those who need money faster than traditional lenders offer

- Those who will be able to pay back the money on the specified due date

Requirements for Quick Cash Payday Advance Loans

Most lenders have their list of requirements for loan eligibility. To save time before applying for payday loans online, please check that you meet some of the basic requirements shared by many lenders:

- You should be a U.S. resident

- You should be at least 18 years of age

- Your bank account should be in good standing

- Your monthly income should be no less than $800

Some consumers think that mistakes in the past bar them from receiving short-term loans. This is not always true. Even if you have suffered bankruptcy, you may not be automatically disqualified for a payday advance. The lender will check your credit, but you may still receive the funding.

What Are the Advantages of a Payday Loan Online?

There are three main benefits of using a shorter-duration loan:

Best of all, payday loans can often be used to cover any expense, from medical bills to debt consolidation to home repairs.

For millions of Americans with a low credit score, finding fast cash is not as easy as walking into a credit union and withdrawing the necessary funds. In fact, the underbanked have few options for acquiring money in an emergency.

Fortunately, a cash advance loan is available in many areas for those willing to pay a higher finance charge. When the bank says "no," consumers are sometimes still able to get their money.

A payday lender may deliver the funds in as little as one business day.

You have options. This is a $9 billion industry, after all. So, why should you choose us?

Besides providing on-screen results within minutes of submitting your loan request, here are some of the ways we stack up against the competition:

We Keep Your Data Safe

One of the questions we hear most often is: "How safe is it to request money online?" Our answer is that we take your data security seriously. All the information you enter into our site is protected with 256-bit encryption.

Why You Can Trust OpenCashAdvance

Whether you request or apply for funding, it is important to follow the best practices for a cash advance loan. There are easy ways to keep your data safe from identity theft, scams, and other dangers. Before entering your personal information into any site for an online payday loan, make sure it meets the requirements outlined in the following checklist.

-

Only work with sites that have an SSL certificate. You can tell if a website is secure by checking for the "HTTPS" protocol. If it is missing the "S" after the "P," then you should look somewhere else for your small-dollar loan. Sites without an SSL may not offer a secure connection between the web server and your browser, providing an easy opportunity for cyber thieves to steal your information.

-

Check the small consumer loan site's Privacy Policy. Websites that ask for your personal information are required to include a Privacy Policy that says what they will do with your information. Stay away from personal loan sites that do not have a policy like this, as well as the ones that include language that makes you feel uncomfortable.

-

You should install internet security software onto your computer to provide added protection. Being proactive about internet safety requires some defensive work on your end. Even if you only visit the best small loan sites, you still risk losing your data if you do not have malware protection installed on your computer, as hackers can and will find ways inside your machine if you let your guard down.

-

Regularly update your passwords on small-dollar loan sites. You should never use the same password twice. If you do, hackers will be able to access more of your accounts after cracking just one of them. It's best to use a variety of passwords while also updating them every several weeks.

-

Request that lenders scrub your information after you finish working with them. Even a simple payday advance inquiry puts your data out there, entering your personal information onto all kinds of lists and ensuring that you will be reached out to again and again. One alternative to that is asking the site to remove all your personal information.

It's essential to respond quickly to messages from your bank and other outstanding accounts if they see any suspicious activity.

Our Lenders are Fast

Lenders may deposit the loan directly into your checking account. The transaction takes at least one business day, and the loan term lasts around a couple of weeks. The lenders we work with provide fast cash for emergencies.

After you receive the funds, you may use it to address many financial emergencies.

Please note that it can be harder to receive a payday loan without a checking account, as this is the preferred way to deposit your loan amount and eventually withdraw the money with the fees on the specified due date.

We May Help You Try to Find a Nearby Payday Loan Online

Using a local lender may increase the odds of being approved for a payday loan and receiving your loan proceeds. Local financial retailers sometimes provide:

- A more subjective process for determining loan worthiness

- Access to products that are not always available online, such as terms available Only in your location

- Greater flexibility for receiving your loan money

Outlets that provide shorter-duration funding are generally more flexible and personable than conventional lenders. Likewise, their requirements for eligibility can be far less strict. A credit score may be less of a factor, and the time it takes for you to be approved is relatively quick.

They can be a viable option when unexpected and costly emergencies present themselves.

If a credit card or personal loan is unavailable to you, it might be best to take out a small-dollar loan to help you with your expenses. Payday loans can be used to pay for utilities, groceries, and medical bills. They can guide you in the right direction and get your life back on track!

Working with a reputable lender may help payday loan borrowers avoid a predatory loan. Those with bad credit are sometimes targeted with a high annual percentage rate on their loan proceeds. A trusted lender may provide a better payday advance experience.

The vast majority of those who look for an internet loan will not find funding that way. However, many of them still may find help from a location closer to home. When you use OpenCashAdvance, you may find a local financial retailer.

Frequently Asked Questions

We have processed more than 2 million payday loan requests through OpenCashAdvance.

Some of these consumers reach out to us with questions. Here are some of the most popular inquiries.

Is a Payday Loan Different From an Installment Loan?

Yes, an installment loan is paid back bit by bit over time. That's not the case with cash advance funding, which borrowers need to pay back in one lump sum on the specified due date.

What Is the Most I Can Borrow?

State regulations limit how much you can borrow through short-term funding in your location. Some cities have their own rules, which may be stricter than federal or state laws. Three-month payday loans are not available in some areas. A reputable lender might be able to help you navigate any restrictions in your area as you try to find a payday advance that fits with a responsible lending plan.

What If I Cannot Pay It Back on Time?

Most lenders will try to automatically withdraw your payment from your checking account on the day your small loan is due. If you do not have enough gross monthly income in your account, you may receive a fee from your bank and the lender. These fees can make it even harder to pay back your loan, so it's essential to reach out to your lender ahead of time and try to work something out with them.

Do You Have a Copy of My Lending Agreement?

No, we are not a lender. If you need to see your loan agreement for any reason, you should contact your payday lender directly. It's important to keep a copy of this documentation for your records. Before signing a loan agreement, you should understand the actual cost of the loan, as well as the penalties for missing a payment.

How High Does My Credit Score Need to Be for Online Payday Loans?

While there is no definitive credit score that will guarantee you a payday loan, it is true that a stronger credit report often makes it easier to find funding. Fortunately for those struggling with a lower score, many lenders will look at other attributes, such as an applicant's gross monthly income, to make a credit decision.

Do Payday Loan Borrowers Pay an Origination Fee?

The payday lending industry looks for many ways to generate loan proceeds. Sometimes, this translates to a higher annual percentage rate. The repayment plan on a deferred deposit loan may also include other fees.

How Can I Manage My Payday Loan Debt?

The Consumer Financial Protection Bureau recommends using caution when borrowing money. It is best to avoid a predatory loan and get credit counseling when necessary.

Payday loan debt needs to be paid back on time. That means finding a repayment plan that works for you. Always pay back cash advances with money you already have, as borrowing money to pay off debt multiplies the interest owed, making it harder to escape the debt. If you are responsible with your money, payday loans may be your best bet to cover sudden expenses.

We hope we can help you find a small loan. Even if the credit bureaus have made it hard for you to find a payday advance loan in the past, we'll do our best to help you try to find an online payday loan.