The Pros and Cons of Having a Joint Credit Card

Loan Advice

Money issues can add stress to a relationship. That's why many couples decide to share and combine their funds and apply for a joint credit account.

Payday Loans for Uber drivers: What to Know

Loan Advice

Being an Uber driver is a great idea when you are looking to make some extra cash on the side or when you enjoy driving full-time. You can set your own hours and work when and where you want.

COVID-19 Money-Management Tips: What to Do with an Inheritance

Best Practices

Losing a loved one is a painful process. Often, people struggle with deciding what to do with the money their loved ones leave behind. For many, that process has only become more stressful as the COVID-19 pandemic continues to impact inheritance proceedings due to court closures.

How to Get a Cash Advance for Social Security Recipients

In any society, a significant percentage of the population lives on minimal income. In the U.S., some of these people rely on social security to meet life’s expenses. There are times when additional funding is necessary.

VantageScore vs FICO Score

Best Practices

It's never been more challenging for U.S. lenders to make credit decisions. COVID-19 put the economy in a tailspin, and lenders are still unsure how to adjust their risk-assessment models to avoid customers who will default on the loan.

Beginner’s Guide to Free Investment Apps

Company Profiles

The pandemic has seen an all-time rise in investment app users, most of whom are young adults with little to no investing experience.

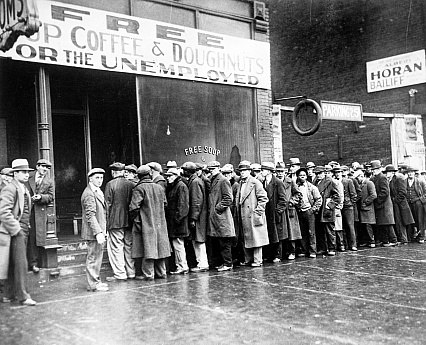

Top 6 Budgeting Tips from the Great Depression

Best Practices

The Great Depression was a catastrophic time in U.S. history when unemployment reached 25% and bank failures eradicated many people’s savings.

Benefits for Disabled Veterans in the U.S.

Best Practices

If you served in the U.S. military and are disabled, you may be entitled to certain services and resources provided by the Department of Veterans Affairs (VA).

What is Credit Counseling and How Does It Work?

Best Practices

If you struggle with efficient budgeting to pay off debts, monthly bills, and other expenses, then it may be time to consider a credit counselor.

10 Super Simple Ways to Start Saving Money from an Expert

Best Practices

I’ve always been a thrifty soul, even as a child. During my adult years of writing professionally for the financial industry, I have learned even more ways to save money. Most of these things are such a big part of my life that they have become second nature.

PayPal Pay in 4 Review

Company Profiles

This holiday season, we look forward to a hopefully brighter future. Home-cooked Thanksgiving meals, hot cocoa by the campfire on Christmas day, getting great deals on Black Friday, and many other things.

What is the Debt Snowball Method?

Is debt inescapable? That perception is true for most, as over 70% of American consumers die in debt. But, it doesn’t have to be that way.

How to Start a Business with a Low Budget

Best Practices

Starting a business with a low budget may be a challenging feat, but it is not impossible. In this day and age, it is common for people to pursue their passions and interests outside of their nine to five jobs as a side project or small business.

Learn More About the Home Depot Loan

Loan Advice

Loans are everywhere. Whether you are looking to purchase a new car, a new home, or even a renovate the one you already own now, loans can be quick cash solutions.

How to Fund Your Home Renovations

Loan Advice

One fear shared by all homeowners is the need for home repairs. It's not hard to see why. Even exciting renovations are unnerving because of the money required.

How to Start Trading on the Stock Market

Best Practices

Before you start trading stocks, there are certain things you need to know about the market before leaping in and investing your money.

Personal and Business Budgeting Tips During a Recession

Best Practices

Economic patterns show that recessions typically occur every four years in the United States.

Home Loans for Single Moms

Loan Advice

Single parents can often feel monetarily strained and may find it difficult to navigate finances with only one income due to a lack of necessary funds.

Unsecured Business Loans: Pros and Cons

Loan Advice

Keeping a business up and running requires a constant flow of cash. This is important to maintain a constant flow of operations, as well as to cover any unexpected emergencies.

How to Plan an Affordable Honeymoon

Best Practices

Each year, roughly 2.4 million weddings take place in the United States. And after these weddings, there are about 1.4 million honeymooning couples. In fact, among those who chose to get married, 99% will typically take a honeymoon following their nuptials.

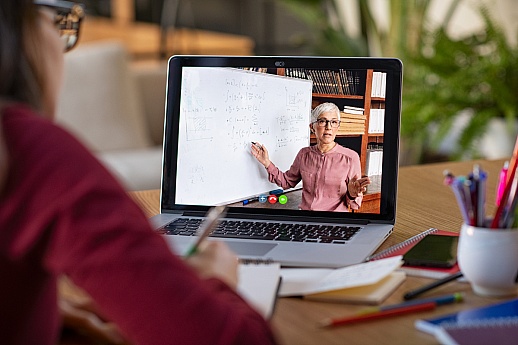

Best 5 Online Personal Finance Courses: Top Picks for Financial Literacy

Best Practices

Looking for a no-cost to low-cost family finance class? These online programs offer the best courses for helping you plan a better budget.

Do Student Loans Affect Credit Score?

Best Practices

To help cover the cost of such steep higher educational costs, many individuals opt to take out student loans.

Protecting Yourself from Credit Card Fraud

Best Practices

About 14.4 million Americans fell victim to identity fraud in 2018, according to the 2019 Identity Fraud Study from Javelin Strategy & Research.

What is a Finance Charge?

Best Practices

A finance charge is a charge placed on your account if you fail to make your payments on time. It may also include interest charges and other fees that lenders charge borrowers, depending on the type of loan they choose.